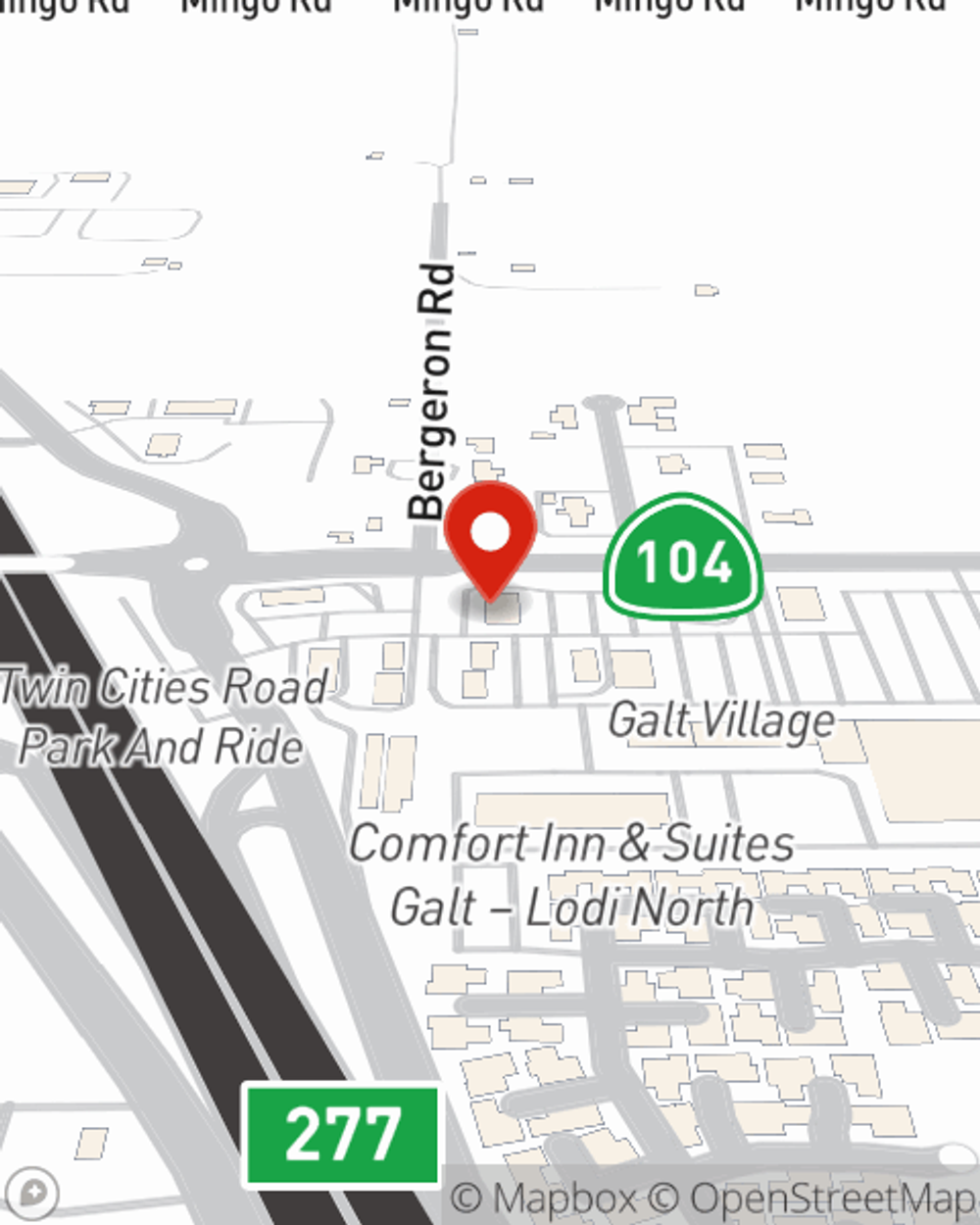

Business Insurance in and around Galt

One of the top small business insurance companies in Galt, and beyond.

Helping insure businesses can be the neighborly thing to do

- Galt

- Wilton

- Acampo

- Lodi

- California

- Thorton

- Stockton

- Elk Grove

- Sacramento

- Rancho Cordova

- Sheldon

- West Sacramento

- Roseville

- Folsom

- Sacramento County

- San Joaquin County

- Placer County

- 95632

- 95638

- 95693

This Coverage Is Worth It.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide quality insurance for your business. Your policy can include options such as errors and omissions liability, extra liability coverage, and a surety or fidelity bond.

One of the top small business insurance companies in Galt, and beyond.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Whether you own a barber shop, a floral shop or a pottery shop, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call or email agent Rachelle Copp to explore your small business coverage options today.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Rachelle Copp

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.